What is Coffee Can Investing

We have all heard of Coffee being served in cans for convenient consumption.

So how about serving hot investments in a Coffee Can? Coffee Can and Investing? How can they be related?

What is Coffee Can Investing?

The term “Coffee Can Investing” gets its name because, in the Old West (in US), people who invested in the stock market would receive physical certificates of proof of their investment which they would then put away in coffee cans.

They would hide these cans in their mattresses and forget about them. These stocks would over some time grow enormously making their buyers rich when they found the cans again.

The term was coined in 1984 by Robert G. Kirby, a Principal Investment Manager with the Capital Group in a paper written by him.

The success of Coffee Can Investing depends entirely on the wisdom and foresight used to select stocks in the portfolio.

As the story goes, Kirby observed the pattern dramatically in the 1950s, when one of his clients who had been widowed, came to him with her deceased husband’s portfolio and wanted the stocks to be added to her portfolio.

Kirby found that her spouse had been blindly following the advice given by the investment companies and had been buying stocks. Though he applied the “Sell” advice to his wife’s portfolio, he never sold any of the shares bought by him.

When Robert Kirby reviewed the portfolio, he found that there were quite a few stocks that were worth $100,000 and one major holding which was worth $800,000 and exceeded his wife’s whole portfolio.

These were shares of a firm called The Haloid Photographic Company, which is now globally known as Xerox Corporation.

This surprised Kirby as the value of the widow’s portfolio, despite being managed by an investment professional, was much lower than that of her spouse. He then concluded that the process of holding the shares for several years and not selling them led to massive wealth accumulation.

He liked this idea and hence termed it as “Coffee Can Investing”.

Although the whole process might seem plain luck, the main objective here is that the investor creates his portfolio by picking stocks and leaves it untouched for a long time.

According to Kirby, if an investor left his portfolio untouched, he would make way more money when compared to regular monitoring of those stocks.

Indian Version of Coffee Can Investing

Coffee Can investing has been proved to be an extremely efficient investment strategy for long-term investors, even in the Indian market.

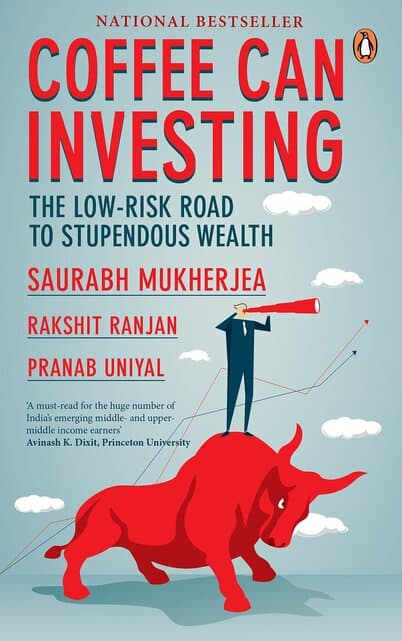

Inspired by it, the analysts at Ambit, India’s premier providers of financial advice, decided to create their version of the Coffee Can Portfolio for Indian equity investors. This is what Saurabh Mukherjea, through his book, “Coffee Can Investing: The Low-Risk Road to Stupendous Wealth” wants us to explore.

Key Takeaways

The key takeaways are:

- Invest for the long term – Long term investments reduce transaction costs and also provide better returns

- Avoid intermediaries as far as possible – Agents and brokers churn your portfolio as every transaction in your portfolio adds to their kitty

- Look carefully for expenses – One should look at the expense ratio while investing in Mutual funds and exit loads ULIP plans as small amounts can lead to a loss of large sums of returns over a while

- Watch out for Liquidity – Real Estate is the most illiquid asset with very high transaction costs as compared to equities

- Patience always pays off – It may seem like a cliche but patience always pays

Consider this. If you had spent Rs 55,000 to buy a Royal Enfield motorcycle in 2001, you would now have had an old, rugged bike. But if you had invested the same Rs 55,000 in shares (at Rs 17.50 per share) of Eicher Motors, the company that makes Enfield bikes, your investment would have been worth Rs 4.75 crore now !!!

- Be clear with your financial goals – The book emphasizes creating a financial plan which will help you deliver on your life goals. Remember the fact that Financial Planning is a dynamic tool and should be done periodically to manage your life goals.

- Never time the market – Trying to time the market and using market-level valuations as a guide to especially make ‘sell’ decisions prove to be counterproductive as companies with sound fundamentals and excellent return ratios will continue to look expensive.

- It’s all about the cash flow – The interesting thing about earnings is that they can be manipulated as per the whims of the management but Cash flow is something that cannot be tampered with. The Cashflow figures, on the other hand, describe clearly how much of the profit is left for shareholders

How to do it?

Here are the steps that you need to take to get the most out of this strategy.

- Pick 20-25 companies with a market cap of Rs.100 crores

- Among those, choose companies that have a ROCE ratio of at least 15% or above for the preceding 10 years

- These companies should have had an annual sales growth of 10% in the past 10 years

- Avoid debt-heavy companies

- Last but not the least, do not churn the portfolio at least for the next 10 years.

The idea behind this is to invest in a company and then forget about it at least for the next decade.

Conclusion

Coffee Can Investing is a smart and profitable strategy for investors who wish to get higher returns and have the patience to hold the portfolio for longer periods.

Howdy!

If you’re here for the first time, let’s get introduced.

VRD Nation is India’s premier stock market training institute and we (Team VRD Nation) are passionate about teaching each and every aspect of investing and trading.

If you’re here for the first time, don’t forget to check out “Free Training” section where we have tons of free videos and articles to kick start your stock market journey.

Also, we got two awesome YouTube channels where you can continue the learning process.

Must-Read Articles

What is Coffee Can Investing

We have all heard of Coffee being served in cans for convenient consumption.

So how about serving hot investments in a Coffee Can? Coffee Can and Investing? How can they be related?

What is Coffee Can Investing?

The term “Coffee Can Investing” gets its name because, in the Old West (in US), people who invested in the stock market would receive physical certificates of proof of their investment which they would then put away in coffee cans.

They would hide these cans in their mattresses and forget about them. These stocks would over some time grow enormously making their buyers rich when they found the cans again.

The term was coined in 1984 by Robert G. Kirby, a Principal Investment Manager with the Capital Group in a paper written by him.

The success of Coffee Can Investing depends entirely on the wisdom and foresight used to select stocks in the portfolio.

As the story goes, Kirby observed the pattern dramatically in the 1950s, when one of his clients who had been widowed, came to him with her deceased husband’s portfolio and wanted the stocks to be added to her portfolio.

Kirby found that her spouse had been blindly following the advice given by the investment companies and had been buying stocks. Though he applied the “Sell” advice to his wife’s portfolio, he never sold any of the shares bought by him.

When Robert Kirby reviewed the portfolio, he found that there were quite a few stocks that were worth $100,000 and one major holding which was worth $800,000 and exceeded his wife’s whole portfolio.

These were shares of a firm called The Haloid Photographic Company, which is now globally known as Xerox Corporation.

This surprised Kirby as the value of the widow’s portfolio, despite being managed by an investment professional, was much lower than that of her spouse. He then concluded that the process of holding the shares for several years and not selling them led to massive wealth accumulation.

He liked this idea and hence termed it as “Coffee Can Investing”.

Although the whole process might seem plain luck, the main objective here is that the investor creates his portfolio by picking stocks and leaves it untouched for a long time.

According to Kirby, if an investor left his portfolio untouched, he would make way more money when compared to regular monitoring of those stocks.

Indian Version of Coffee Can Investing

Coffee Can investing has been proved to be an extremely efficient investment strategy for long-term investors, even in the Indian market.

Inspired by it, the analysts at Ambit, India’s premier providers of financial advice, decided to create their version of the Coffee Can Portfolio for Indian equity investors. This is what Saurabh Mukherjea, through his book, “Coffee Can Investing: The Low-Risk Road to Stupendous Wealth” wants us to explore.

Key Takeaways

The key takeaways are:

- Invest for the long term – Long term investments reduce transaction costs and also provide better returns

- Avoid intermediaries as far as possible – Agents and brokers churn your portfolio as every transaction in your portfolio adds to their kitty

- Look carefully for expenses – One should look at the expense ratio while investing in Mutual funds and exit loads ULIP plans as small amounts can lead to a loss of large sums of returns over a while

- Watch out for Liquidity – Real Estate is the most illiquid asset with very high transaction costs as compared to equities

- Patience always pays off – It may seem like a cliche but patience always pays

Consider this. If you had spent Rs 55,000 to buy a Royal Enfield motorcycle in 2001, you would now have had an old, rugged bike. But if you had invested the same Rs 55,000 in shares (at Rs 17.50 per share) of Eicher Motors, the company that makes Enfield bikes, your investment would have been worth Rs 4.75 crore now !!!

- Be clear with your financial goals – The book emphasizes creating a financial plan which will help you deliver on your life goals. Remember the fact that Financial Planning is a dynamic tool and should be done periodically to manage your life goals.

- Never time the market – Trying to time the market and using market-level valuations as a guide to especially make ‘sell’ decisions prove to be counterproductive as companies with sound fundamentals and excellent return ratios will continue to look expensive.

- It’s all about the cash flow – The interesting thing about earnings is that they can be manipulated as per the whims of the management but Cash flow is something that cannot be tampered with. The Cashflow figures, on the other hand, describe clearly how much of the profit is left for shareholders

How to do it?

Here are the steps that you need to take to get the most out of this strategy.

- Pick 20-25 companies with a market cap of Rs.100 crores

- Among those, choose companies that have a ROCE ratio of at least 15% or above for the preceding 10 years

- These companies should have had an annual sales growth of 10% in the past 10 years

- Avoid debt-heavy companies

- Last but not the least, do not churn the portfolio at least for the next 10 years.

The idea behind this is to invest in a company and then forget about it at least for the next decade.

Conclusion

Coffee Can Investing is a smart and profitable strategy for investors who wish to get higher returns and have the patience to hold the portfolio for longer periods.

Leave A Comment