What is Reverse Pyramiding

Introduction

Pyramiding refers to the position sizing technique where we only add to the position if the trade is working out.

So, let’s say we start with 50% of the capital and if the trade turns profitable, you can add 30%, 15% & 5%…we have made dedicated videos

Now, reverse pyramiding is a slight modification to this approach.

Here, we basically invert the pyramid….make it upside down.

So, we enter with a smaller capital and once the trade starts working out, we add bigger capital than we first added.

But why would one do reverse pyramiding? Title Text

Now, in my experience, reverse pyramiding works best when you take a contrarian trade against the market. Text

For example, if a stock has fallen a lot but recently you see some signs of base formation and even reversal.

It makes more sense to enter with a small quantity and then if the trade starts working out, add the significant portion of capital because you know that your view has turned out fine.

If the trade works out, you end up making a lot of money but even if it didnt, your loss would be much smaller.

So, guys, there is no rocket science here….just common sense in using reverse pyramiding.

Introduction

Iceberg orders in Zerodha are a way to break down a large order into multiple smaller orders.

Let’s say, you have to buy 10,000 shares of Reliance.

So, instead of placing one giant order of 10,000, you can place 5 orders of 2000 quantity each using Iceberg orders.

Iceberg orders were originally created for big institutions and High Net Worth (HNI) clients who deal with huge order sizes and they don’t want people to know that they’re placing these big orders.

Hence, they broke the big quantities into multiple small orders so that people would not know that there is a big participant out there and hence their actions should not influence the price of the script that they are trading.

Now, thanks to Zerodha, Iceberg orders are available to retail traders as well.

Let’s take an example

Please watch the video below to understand how to place Iceberg orders but if you can’t just read on.

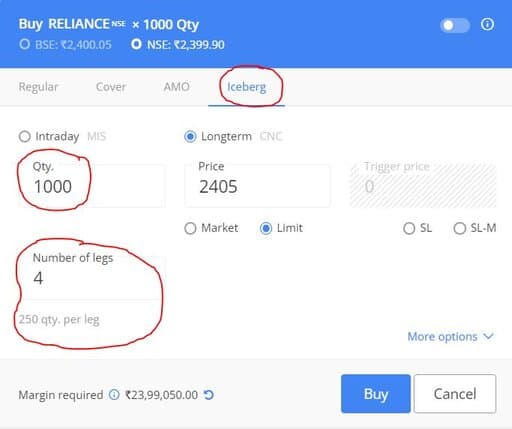

Iceberg orders look like this.

In this example, notice how an Iceberg order can be used to break down the quantity of 1000 into 4 orders of 250 quantity each.

So, what happens when you place this order?

Zerodha will place the first order of 250 quantity and wait for it to get executed. If it executes, Zerodha will place the second order and so on and so forth. Basically, these orders are placed sequentially – one after the other.

Important facts about Iceberg orders

Brokerage

Breaking a large order in multiple smaller orders look like fun and convenient but there is also a cost associated with it.

Because for every leg of the order, you have to pay separate brokerage.

So, if we take the same example as above, if you had place a regular order of 1000 quantity, you would have paid only 20 rupees in brokerage. However, if you use Iceberg orders, now you have to brokerage for each leg (i.e 4 x 20 = 80 rupees).

This might seem like a small amount now but if you a regular trader, then this will add up over time.

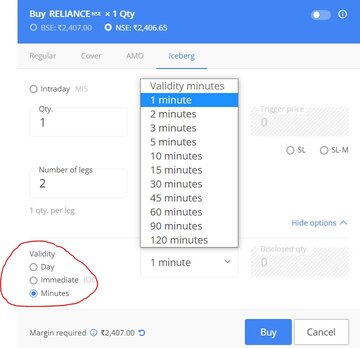

Validity

You can also specify the duration for which the Iceberg order will be valid.

In this case, for example, you can say that if my order doesn’t get execute in the next 5 mins, just cancel it. This feature might be useful for those who are expecting a quick move in a stock but if that doesn’t happen, they don’t want to stick around for that.

Just cancel the whole things and move on to the next trade.

Benefits of Iceberg Orders

Let’s summarize the benefits of Iceberg orders:

- Breaks down a large order into smaller parts

- This can be very helpful for big institutions and HNI traders who do not want everyone to know that they are buying or selling a big quantity

- Great for overcoming order freeze limits

- Exchanges have restricted the maximum quantity for derivative contracts

- For Nifty, it is currently 2800 and for Bank Nifty, it is currently 1200

- So, if you have to place an order above this quantity, you need to manually place several regular orders

- But with the help of Iceberg orders, you can just place one order that will take care of the problem

- This is of great help for expiry day trading, where the quantities can easily go in thousands

- Canceling one leg automatically cancels the rest

- If any leg of an Iceberg is cancelled, all the remaining pending legs that are yet to be placed will be automatically cancelled.

- Similarly, if the price of any leg of the Iceberg is modified, the new price will automatically be applied to all the pending legs

Limitations of Iceberg Orders

Here are the key limitations of Iceberg orders

- Higher brokerage

- As we saw, brokerage is charged separately on each leg

- Therefore, the brokerage charges will add up over time

- Availability

- Iceberg orders are available for NSE equity, F&O, currency, BCD segment and BSE equity only.

- Iceberg order type isn’t available for MCX yet.

- Pre/Post market

- Iceberg orders and minute validity are not supported during pre-open & post-market sessions.

Final thought

Iceberg order is a great functionality for active traders who deal with heavy quantities but if you work with smaller quantities, it doesn’t make any sense to pay extra brokerage for using Iceberg orders.

![What is Virtual Contract Note [Zerodha]](https://www.vrdnation.com/wp-content/uploads/2023/10/maxresdefault-virtual-note-500x383.jpg)

Leave A Comment