What is Virtual Contract Note In Zerodha?

Introduction

In trading, a contract note is a legal document that confirms transactions made by an investor through a stockbroker. It provides detailed information about the trade and acts as an official record of the transaction.

One of the most important things a contract note tells is the charges we are paying to the broker and government.

If the charges are too high, it means that the trader is overtrading and that’s clearly not a good idea.

Problem with the regular contract notes

Now, the problem with regular contract notes is that they are generated after the fact.

This means that they are generated the next day and by that time, we don’t bother to know the charges and tend to move on.

This prevents us from knowing in real-time how good or bad we are doing with respect to overtrading.

Virtual contract note

A virtual contract note solves that problem.

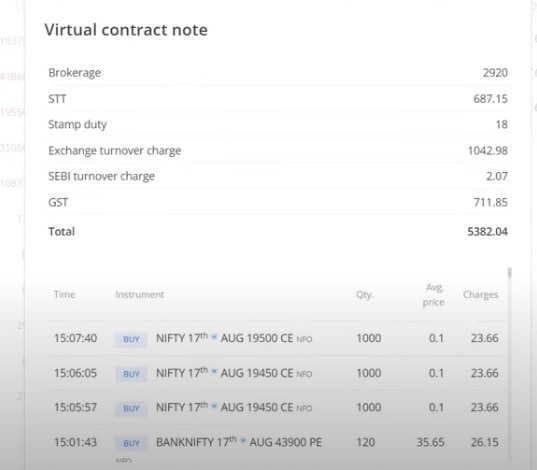

Zerodha has introduced a new feature called “virtual contract note”, through which traders can check in real-time how much charges they would be paying in brokerage and government taxes.

This is a really powerful feature. Watch this video to learn more about it.

Virtual contract notes

More about contract notes

A contract note typically includes the following information:

1. Client Information: This section includes the name, address, and unique client identification of the investor who initiated the trade.

2. Broker Information: It includes the name and contact details of the stockbroker or trading member through whom the trade was executed.

3. Trade Details: This section provides information about the trade, such as the date of the transaction, the security being traded (e.g., stock, commodity, or derivative), and the quantity of the security bought or sold.

4. Transaction Type: Indicates whether the trade is a buy or sell transaction.

5. Price: The contract note specifies the price at which the securities were bought or sold.

6. Charges and Taxes: Details of brokerage charges, transaction fees, taxes (e.g., Securities Transaction Tax or STT, Goods and Services Tax or GST), and any other fees associated with the transaction are included.

7. Total Amount: This section calculates the total amount payable by the investor (in the case of a buy transaction) or the total amount receivable (in the case of a sell transaction).

8. Unique Contract Note Number: Each contract note is assigned a unique reference number for tracking and verification purposes.

9. Signature and Stamp: The contract note is usually signed by the authorized representative of the broker or trading member and includes the official stamp.

Investors should carefully review the contract note to ensure that the trade details match their expectations and that all charges and taxes are correctly applied.

It also serves as a critical document for record-keeping and is often used for accounting, tax reporting, and auditing purposes. It provides transparency and a legal record of the trading activities between the investor and the broker.

Conclusion

So, in conclusion, virtual contract notes are a fantastic way to keep an eye on trading related charges and take corrective actions as necessary.

Howdy!

If you’re here for the first time, let’s get introduced.

VRD Nation is India’s premier stock market training institute and we (Team VRD Nation) are passionate about teaching each and every aspect of investing and trading.

If you’re here for the first time, don’t forget to check out “Free Training” section where we have tons of free videos and articles to kick start your stock market journey.

Also, we got two awesome YouTube channels where you can continue the learning process.

Must-Read Articles

What is Virtual Contract Note In Zerodha?

Introduction

In trading, a contract note is a legal document that confirms transactions made by an investor through a stockbroker. It provides detailed information about the trade and acts as an official record of the transaction.

One of the most important things a contract note tells is the charges we are paying to the broker and government.

If the charges are too high, it means that the trader is overtrading and that’s clearly not a good idea.

Problem with the regular contract notes

Now, the problem with regular contract notes is that they are generated after the fact.

This means that they are generated the next day and by that time, we don’t bother to know the charges and tend to move on.

This prevents us from knowing in real-time how good or bad we are doing with respect to overtrading.

Virtual contract note

A virtual contract note solves that problem.

Zerodha has introduced a new feature called “virtual contract note”, through which traders can check in real-time how much charges they would be paying in brokerage and government taxes.

This is a really powerful feature. Watch this video to learn more about it.

Virtual contract notes

More about contract notes

A contract note typically includes the following information:

1. Client Information: This section includes the name, address, and unique client identification of the investor who initiated the trade.

2. Broker Information: It includes the name and contact details of the stockbroker or trading member through whom the trade was executed.

3. Trade Details: This section provides information about the trade, such as the date of the transaction, the security being traded (e.g., stock, commodity, or derivative), and the quantity of the security bought or sold.

4. Transaction Type: Indicates whether the trade is a buy or sell transaction.

5. Price: The contract note specifies the price at which the securities were bought or sold.

6. Charges and Taxes: Details of brokerage charges, transaction fees, taxes (e.g., Securities Transaction Tax or STT, Goods and Services Tax or GST), and any other fees associated with the transaction are included.

7. Total Amount: This section calculates the total amount payable by the investor (in the case of a buy transaction) or the total amount receivable (in the case of a sell transaction).

8. Unique Contract Note Number: Each contract note is assigned a unique reference number for tracking and verification purposes.

9. Signature and Stamp: The contract note is usually signed by the authorized representative of the broker or trading member and includes the official stamp.

Investors should carefully review the contract note to ensure that the trade details match their expectations and that all charges and taxes are correctly applied.

It also serves as a critical document for record-keeping and is often used for accounting, tax reporting, and auditing purposes. It provides transparency and a legal record of the trading activities between the investor and the broker.

Conclusion

So, in conclusion, virtual contract notes are a fantastic way to keep an eye on trading related charges and take corrective actions as necessary.

Leave A Comment